Resumption of rate-cutting cycle bodes well for the prospect of further rate cuts in 2025

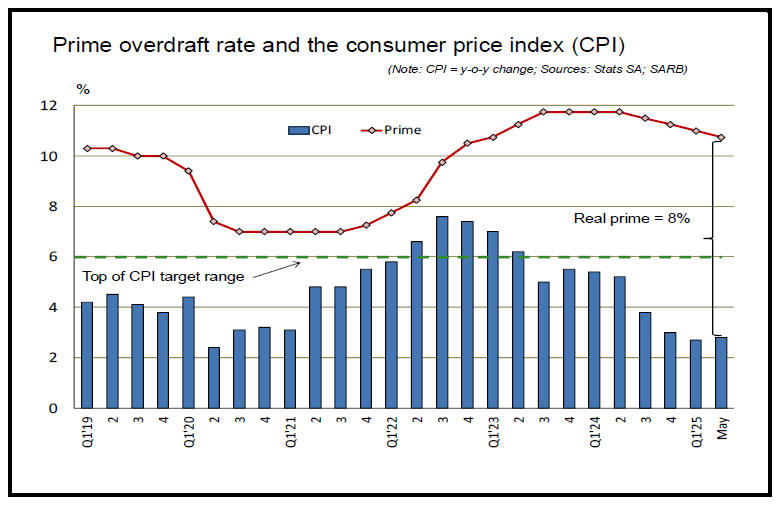

The Monetary Policy Committee (MPC) of the Reserve Bank lowered the repo rate by 25 basis points at its May policy meeting, after stalling the rate-cutting cycle in March. This was the fourth rate cut since September last year, with the prime overdraft rate of the commercial banks now standing at 10.75%. Compared to the beginning of 2020 (just before the Covid-19 pandemic), the prime rate is still 75 basis points higher.

Although millions of indebted South African households and prospective home buyers would have been delighted at the latest interest rate cut, there is still a long road ahead before the real prime rate (prime minus CPI) can drop to the level of around 5.5% that existed before Covid. With the consumer price index (CPI) now at 2.8%, the current real prime rate is 8%, which represents an increase in the real cost of credit of almost 50%.

A significant percentage of residential property sales are related to owners that cannot afford the sharp increase in the debt service costs/disposable income ratio, which is currently 8.9% and still 33% higher than at the beginning of 2022. Fortunately, the producer price index (PPI), which is a leading indicator for consumer inflation, is at a record low of 0.5%, which bodes well for the prospect of further rate cuts in 2025.

Sound prospects for summer grain harvest

In its most recent update for the country’s summer grain and oilseeds harvest, the Crop Estimates Committee of the Department of Agriculture, Forestry & Fisheries has provided encouraging news. Until recently, the prolonged and irregular summer rains had raised concerns over the ability to harvest crops prior to an inevitable decline in quality that eventually sets in. According to the Agriculture Business Chamber, these fears have been largely allayed.

The latest estimate is for a harvest of just below 18 million tons, which is 16% larger than last year’s crop. Maize accounts for 14.64 million tonnes of this estimate. Domestic consumption of maize (including animal feed) is just below 12 million tonnes, which guarantees another solid contribution to export earnings by the country’s farmers.

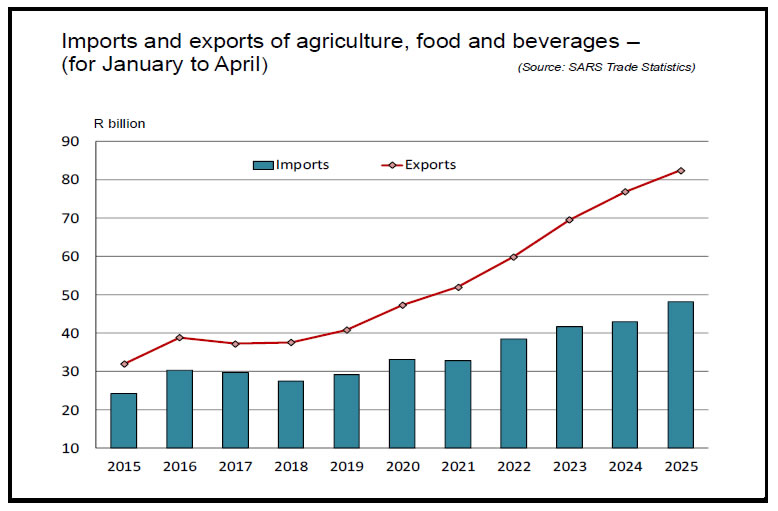

Over the past eight years, South Africa’s exports of agriculture and processed food and beverages have continued to surpass imports by a healthy margin. In the process, this sector has become the fourth largest contributor to the country’s foreign exchange earnings and has cemented its status as a strategic industry, also because of its indispensable role in providing employment to 930,000 people.

Rand remains resilient

During May, most key currencies took advantage of the lethargic performance of the US dollar, with the bulk of the 16 currencies monitored by Currencies Direct strengthening against the greenback. The South African rand was the star performer during May, leaving all other emerging markets in its wake. Compared to the trade-weighted average appreciation of 0.7% against the dollar by a core group of eleven key emerging market currencies, the rand gained 3.1%. In the process, the real effective exchange rate (REER) of the rand (the average exchange rate against the country’s 20 largest trading partners, adjusted for inflation), rose to its highest level in 14 years.

Motor vehicle sector recovers

The modest relaxation of monetary policy since September last year has clearly provided South Africa’s motor vehicle sector with a measure of impetus, with the Drive.co.za Motor Index (DMI) having increased by 3.9% in the 1st quarter of 2025 (in real terms, compared to the 1st quarter of 2024). It is encouraging to note that nine of the twelve indicators comprising the DMI experienced positive year-on-year growth during the 1st quarter of 2025, including new vehicle sales values and the number of new vehicles sold.