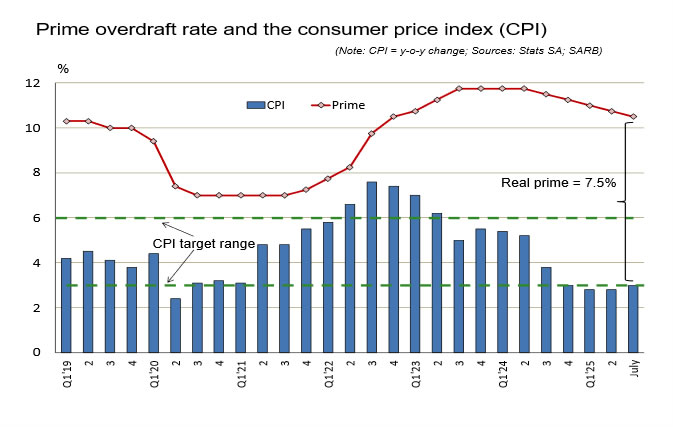

Prime lending rate drops to 10.5%

During the last week of July, the Monetary Policy Committee (MPC) of the Reserve Bank cut the repo rate by another 25 basis points – the fifth cut since the modest easing of restrictive monetary policy that commenced in September last year.

With the consumer price index at 3% (at the bottom point of the inflation target range) and the producer price index remaining at record low levels (0.6% in July), the decision by the MPC was not surprising.

Unfortunately, a hawkish policy approach had been in place for the better part of three years, despite the absence of any sign of demand inflation. Since the unduly restrictive monetary policy started to hamper growth in demand, South Africa’s GDP growth rate has remained below one per cent.

The latest rate cut has been welcomed as it relieves the debt servicing burden of millions of households. The official bank rate is now 7%, with the prime overdraft rate at 10.5%, which is still 50 basis points higher than pre-pandemic.

South Africa’s ten-year bond yield provided a clue to the inevitability of a repo rate cut, as this benchmark capital market rate dropped to 9.6% at the end of July – a decline of 150 basis points since the spike in March (caused by the impasse with the 2025 national budget).

South Africa’s residential property market is bound to gain some traction as a result of the lower interest rate, although some real estate firms canvassed by Property24 have noted that more rate cuts would be required to lift the sector to the activity levels achieved in 2022.

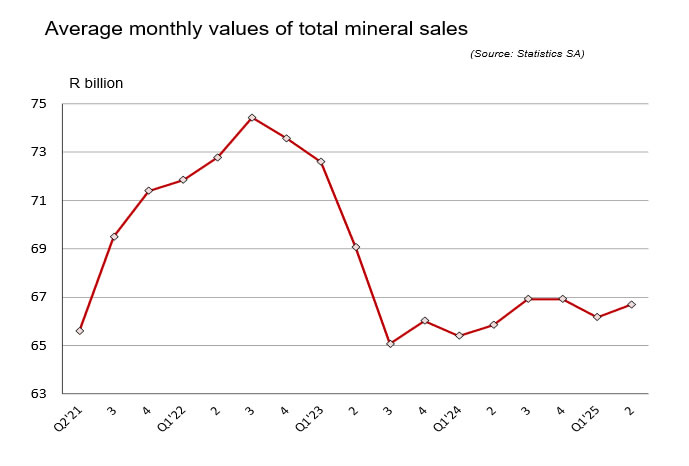

Rebound for mineral sales

South Africa’s mineral sales have enjoyed a splendid start to the second quarter of 2025, with April and May posting a 10% year-on-year increase over the same two months last year. The quarter-on-quarter increase for average monthly sales was even more impressive, with a gain of 24%.

May was a particularly profitable month for the country’s mining industry, with an average month-on-month increase in sales values of 14% for the so-called “big-four”, namely gold, platinum group metals, coal and iron ore. Should these trends continue, it bodes well for the ability of the National Treasury to surpass its revenue budget in the current fiscal year, which could well provide some leeway for larger expenditure on repairing the country’s infrastructure.

SA tops MSCI Property Index

South Africa’s commercial property market has outperformed the other 23 countries included in the annual MSCI/Absa Global Property Index, achieving a total return of 11.9% for the 12 months ending December 2024. The index posted a third consecutive year of capital growth and its best total returns since 2015.

The sustained recovery of commercial property in South Africa reflects strengthening property fundamentals, diminishing political uncertainty following the formation of the Government of National Unity (GNU), the easing of loadshedding, and the onset of an interest rate cutting cycle. Data from the SA Property Owners’ Association reveals annualised trading growth of 4.5% for institutionally owned shopping centres in 2024, above the latest annualised consumer price index of 3%.

Manufacturing PMI expands again

The seasonally adjusted Absa Purchasing Managers’ Index (PMI) for manufacturing moved into expansionary territory in July, after spending ten successive quarters below the neutral mark of 50 (a reading above 50 indicates increased activity and below 50 equates to decreased activity). The welcome increase in the PMI to 50.8 in July 2025 was mainly due to a recovery in demand, with new sales orders rising by 9.7 points to 55.9.

Although July witnessed a modest decline of the sub-index tracking expected business conditions in six months’ time, it is encouraging that the latest level of 56.4 remains in anticipated expansionary territory.